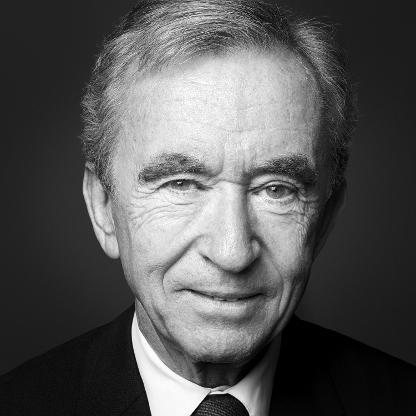

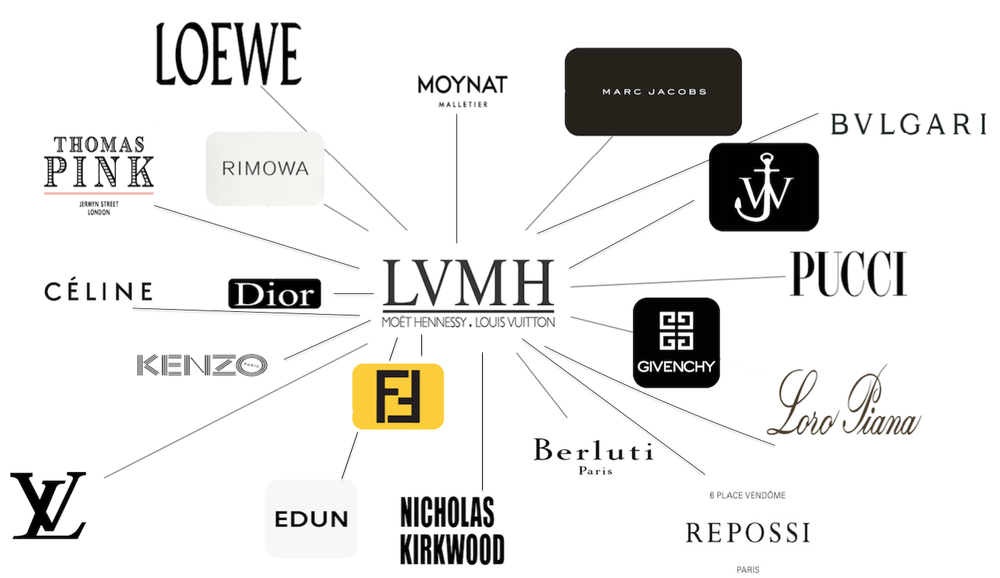

Despite having investments in everything from perfume to hotels and everything in between, LVMH is rooted in high fashion. It all started in 1984 when Bernard Arnault, then 35, bought Christian Dior’s ailing parent company, Boussac, with $15 million of his own money and a $45 million loan from Lazard-Frères. By selling off pieces of the once-prominent textile company, he brought Boussac out of bankruptcy and conveniently gained a majority stake in Dior. From there, Arnault has gone on to acquire 17 different high fashion houses. In 1987, following his success with Dior, Arnault acquired Louis Vuitton-Moët Hennessy, from which the conglomerate gets its name. In 1988, he bought Givenchy; in 1993, Berluti and Kenzo. In 1996, Arnault brought Céline and Loewe under the LVMH umbrella. In 1999, LVMH increased its stake in the Gucci Group to a majority 34.4%. However, François Pinault and rival holding company, Kering, bought out LVMH’s shares for $800 million. From 2000 on, Arnault has acquired Fendi, Bulgari, Loro Piana, and JW Anderson, among others. For a while, LVMH also maintained a 23% stake in French icon, Hermès.

Now, with revenues skyrocketing to record levels, despite market pressures, LVMH is well-positioned to further expand its imposing presence in the luxury market. According to the group’s 2019 Annual Report, revenues rose by an incredible 15% to $58 billion, with earnings for the Fashion & Leather Goods sector alone growing by an unheard of 20%. This daunting level of success has provided Arnault, the second wealthiest man in the world, with $6.8 billion in operating free cash flow for new acquisitions, of which he has already taken advantage. At the end of 2019, LVMH acquired the iconic American jeweler, Tiffany & Co., for an astonishing $16 billion, and according to reports, Arnault is also in talks to secure a majority stake in British-favorite Stella McCartney’s eponymous label.

However, as Arnault snaps up label after label, becoming a sort of corporate raider of emblematic brands, has he overstepped the boundaries of a holding company and created a monopoly? LVMH’s market capitalization, which currently sits at $210 billion, is not only larger than other luxury conglomerates, such as Kering and Richemont, whose market caps are $70.4 billion and $42.3 billion, respectively, but is larger than every European company except for oil giant Royal Dutch Shell. Smaller fashion conglomerates, such as Capri, which owns Versace, Jimmy Choo, and Michael Kors, have market caps that are nearly 15 times smaller than that of LVMH and revenues of only $6 billion—what would only constitute 11% of LVMH’s earnings for 2019.

Ultimately, in building the LVMH brand, Bernard Arnault has amassed an overwhelming majority share of the high fashion market, making it difficult for other publicly traded brands to survive without a buyout. However, with LVMH’s continuous, stunning success and a prodigious investor like Arnault at the helm, there are seemingly no limits to what LVMH can become or what it can buy. As the saying goes, whoever said money can’t buy happiness didn’t know where to shop.