By: Brooke Herigon

Learning how to budget can be hard, sigh. With constant temptations from Amazon, Postmates, and Sephora, budgeting is a skill that takes time to master. A college student budget with champagne dreams can be hard to manage, but by tracking your expenses you can really paint a clear picture of where your fund$ are going. According to a Forbes article about managing your money in college, there are several steps that college students can take to ensure financial success throughout college and after. Here are a three, quick tips for managing YOUR cash!

1. Download a money managing app

Tracking your expenses via an app is a great way to track your spending with just a few screen swipes and taps. The finance app, “Mint” organizes your spending into different categories. This makes it easy to see which areas could use a little improvement (clothes & beauty always ugh).

2. Save a little each month

Saving a small amount each month is a great way to start contributing to your future financial success. Trust in the trust! By saving just $5 each month, you can get into the habit of saving so it will just become second nature. You know your parents would be so proud.

3. Watch out for recurring expenses

Another tip? Watch out for recurring, pricey expenses like books. There are many great resources to find cheap, school books (shout out Amazon) that sometimes will end up saving you hundreds of dollars.

Now that we’ve gotten through the basics let’s get into the fun stuff! I asked three, SMU students to track their weekly expenses and see how THEY spent their moola for the week.

Spoiler alert: Starbucks and food delivery.

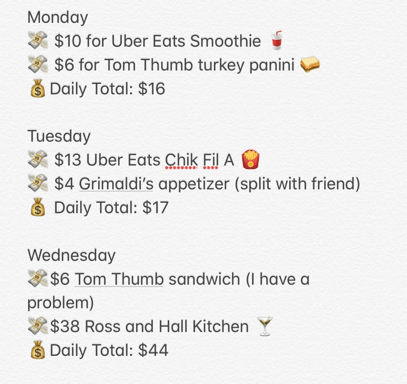

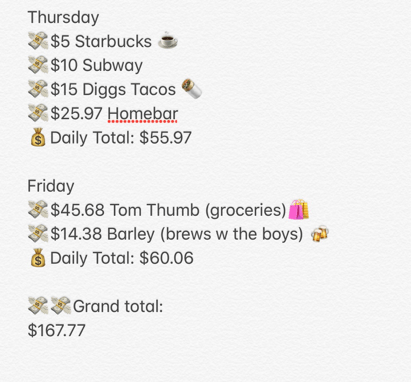

Name: Claire

Age: 21

Occupation: Part-time employee for Red Bull

Claire’s expenses are probably similar to many college students spending the majority on food and food delivery. With services like UberEats and Postmates, it can be easy to fall in love with the convenience of having whatever you want delivered to your doorstep. However, beware of hidden fees that may be applied after your delivery! These costs can add up fast, especially during surge hours (post Homebar).

Name: Alex

Age: 21

Similar to Claire, Alex spent the majority of his spending on food and alcohol. Shocker! College students really are predictable when it comes to our love for carbs.

Name: Annie

Age: 22

Being a girl is expensive! Annie’s nail and spa charges added up making her grand total the costliest. Annie’s grocery haul at the beginning of the week seemed to help her cut down on food costs throughout the other days. Being a smart grocery shopper is for sure a talent. I like to focus on stocking up on healthy snacks and easy meals when at the grocery store to ensure no food I buy goes to waste.