People have long enjoyed shaming fast fashion. The black sheep of the fashion world, fast fashion giants like Boohoo, H&M, ASOS, and Inditex are consistently criticized for stealing their designs from established brands and engaging in unsustainable practices. In most cases, accusations like these are wholeheartedly inaccurate and based on practices from long ago. Furthermore, these complaints only surface in environmental debates where protesters, eager to hate on luxury, reach for the lowest hanging fruit.

However, as COVID-19’s far-reaching effects continue to roil the fashion industry, fast fashion brands have come out stronger than ever, bucking all industry trends. While iconic brands have been crushed under the increasing weight of prolonged store closures, consumer wariness, and an expensive backlog of inventory, fast fashion has used its flexible business model to its advantage, pivoting its production toward lockdown categories and expanding its already-massive online presence.

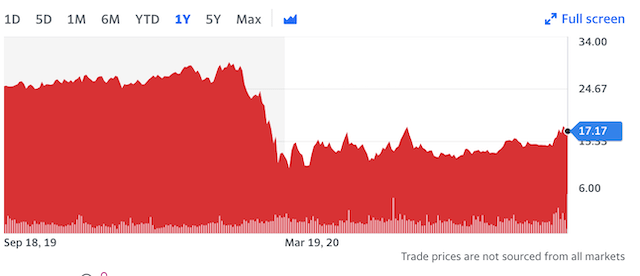

Of the major fast fashion groups, ASOS and Boohoo have been the most successful during the pandemic. Amazingly, both conglomerates beat their 2019 results. In its trading statement for the period ended on June 6th, 2020, ASOS recorded revenues of £1.014 billion, a 10% increase compared with the same period in 2019. The group’s active consumer base also increased to 23 million people, up 16% on the year. More impressively still, despite demand for occasion wear—ASOS’s best category—dropping due to quarantine, the group reported a 15% item growth; meaning that customers bought 15% more on average than they did in 2019. Finally, and most impressively, ASOS reported its strongest month on record for its social media platforms, boasting a 90% increase in activity during the month of May with over 9 million likes, comments, and shares.

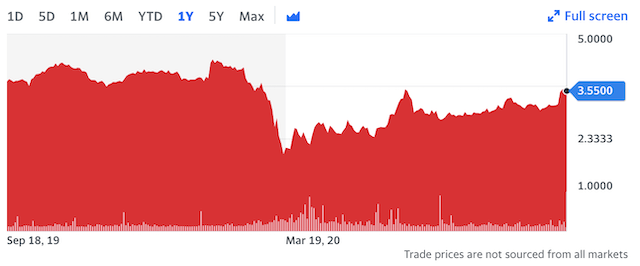

Boohoo posted similarly unbelievable results. In its 2020 Annual Report, the group, whose most notable brands include Pretty Little Thing, Nasty Gal, and Boohoo, reported £1.235 billion in revenue, a staggering 44% increase from the year prior. The brands’ individual performances were just as impressive. Pretty Little Thing (PLT) posted a 38% increase in revenues and a 26% increase in its active customer base. Boohoo’s revenues also increased by 38%, while its active customer base shot up 28%. Cult-favorite Nasty Gal boasted a whopping 106% increase in revenues and a staggering 88% growth in its active customer base. In addition to its stunning results, Boohoo’s CEO, John Lyttle, highlighted the group’s continued automation of its 2 distributive facilities—making its shipments even faster and its business model that much more efficient—as well as its recent expansion of its in-house app development team.

Though they didn’t beat their 2019 results, Inditex and H&M performed well, showcasing the enviable flexibility of the fast fashion business model. In its 6-month financial presentation, reporting activity from February 2 to July 31, 2020, Inditex—owner of Zara, Pull&Bear, Massimo Dutti, Berksha, Uterqüe, and Stradivarius—posted net sales of €8 billion, compared to €12.8 billion during the same period in 2019. This led to a loss of €195 million for the first half (H1) of 2020, compared to a net income of €1.5 billion during H1 2019. Despite this drop, the group’s business model has allowed it to better adapt to the pandemic than those of artisanal and specialty brands. During H1 2020, the group’s online sales rose by a stunning 74%, and its supply chain remained completely uninterrupted during the pandemic. And, while most brands became inundated by immobile inventory, Inditex’s inventory declined 19%, as it was able to quickly adapt its rate of production to the sudden drop in purchases.

H&M posted a 23% drop in net sales for H1 2020, but a 36% increase in online sales, a trend that has continued even as the brand’s physical stores have begun reopening, according to Helen Helmersson, H&M’s CEO.

Ultimately, all four of these fast fashion groups have put traditional fashion conglomerates, like Tapestry and Capri, to shame. In its 10k form filed on August 13, 2020, Tapestry—which owns Kate Spade, Stuart Weitzman, and Coach—reported an alarming net loss of $652.1 million, compared to a net income of $643 million a year prior. The group also reported a loss in operating income of $550.8 million, compared to a gain of $819.7 million during the same period in 2019. These disappointing numbers, along with operational issues and the group’s lacking online presence have left investors worried for the group’s long-term success.

Capri—which owns Versace, Jimmy Choo, and Michael Kors—posted similarly abysmal numbers for the period ending June 6, 2020. The group reported revenues of $451 million, a 66.5% drop from the same period a year prior, and a net loss of $180 million, compared to a net income of $45 million in 2019. Not only did each of the brands incur massive operating losses, but they each saw huge declines in revenue; Versace declining by 55.1%, Jimmy Choo by 67.7%, and Michael Kors by 68.7%.

So, why is fast fashion winning? And, better yet, why are some fast fashion groups thriving in the panic-ridden coronavirus market?

From my perspective, fast fashion is winning for 6 big reasons:

1.) Pricepoint

In a time as economically insecure as COVID-19, few people are on the market for a new pair of Jimmy Choo pumps or a Versace handbag. When the market is volatile, consumers get scared. As a result, they hunker down, free up cash, and cut back their nonessential spending. Unfortunately for high fashion, that means cutting back on big purchases. Fast fashion thrives on these scared consumers, who go to H&M and Zara looking for something that looks high fashion, but won’t break the bank.

2.) Online Presence

Unlike luxury and heritage brands who market themselves to a small, loyal consumer base through magazine spreads, private sales events, and first looks, fast fashion commands social media, advertising on Instagram posts, Snapchat stories, and Facebook feeds. The ability to reach a wide range of consumers through social media makes fast fashion accessible to everyone. Think about it: thanks to Instagram, you can literally shop the sweater you saw on H&M’s page in 2 clicks.

3.) Constant Newness

Boohoo boasts that its brands launch new styles every single day. This means that if you were to shop Boohoo every day, you would never repeat a purchase. For fast fashion’s target audience, dropping new styles every day is far superior to waiting for a new collection to drop every six months. When there’s always something new to shop, people will always be shopping.

4.) Collabs

While Nasty Gal does collections with Emily Ratajkowski, Ariana Grande, and Saweetie, high fashion rarely does collaborations. Sure, Kendall Jenner is the face of Versace, but the bag she’s holding isn’t Kendall x Versace. Without collabs, it’s difficult for brands to build hype, which is what fast fashion’s target audience lives for.

5.) Efficiency, efficiency, efficiency

The fast fashion business model is truly unbeatable. While heritage brands like Coach have to source the highest quality leather for its bags, hire workers capable of handcrafting its bags, and roll out an extended production timeline for each item because they are handcrafted, fast fashion has no such road blocks in the production process. This allows them to automate their supply chains, expedite production, and drive down production costs in a way that is impossible for iconic brands.

6.) Sustainability Initiatives

Finally, fast fashion is changing its image. While it has long been associated with waste, brands like H&M and Nasty Gal are changing this. Recently, H&M has been running ads showcasing its increased use of recycled materials; from a shirt made of orange peels, to shoes made of recycled glass beads, to a dress made from 100% recycled polyester. In addition to using recycled products in its new collections, Nasty Gal has introduced Nasty Gal Vintage, a curated collection of vintage pieces from both the brand’s past collections as well as those from outside labels.

In closing, fast fashion is nothing to scoff at. While iconic brands like Stuart Weitzman and Coach have struggled mightily to attract even their loyal consumer base, fix their interrupted supply chains, and drive down their operating costs, fast fashion has defied all expectations in a market beholden to the woes of COVID-19, demonstrating the importance of a flexible business model, a dominant online presence, and accessible prices for even the most unconfident consumer.

Iconic brands may fade, but fast fashion is here to stay.