By: Hannah Blake & Eileen Barrett

College has finally come to a close, my mind filled with large ambitions. As I walked across the stage during graduation with a proud smile from ear to ear, I quickly grabbed the diploma and tightly wrapped my fingers around. Suddenly, reality started to set in that I was about to enter the real world. Ideas started to flow into my mind. How will I be able to pay for everything? How will I plan out my finances? Where will I live? How much will I pay for rent? What will I need for my future apartment? Where can I buy affordable furniture? The idea of getting a job and finding and apartment might sound exciting and fun at first glance, however, it can be draining, and the excitement dissipates quickly. Once you start looking you also start to realize the details that you seldom knew existed. To make this daunting transition an easier process, we have constructed a quick guide to prepare you for entering reality.

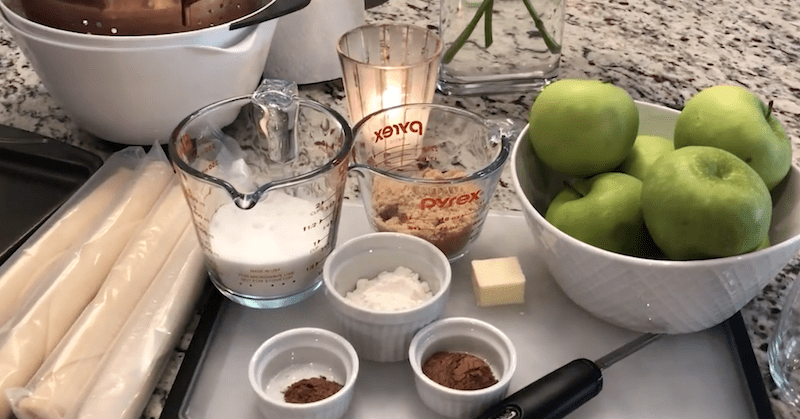

Finances: As college students graduate, some start to get cut off by their parents. This occurs either cold turkey or over time, as some still receive assistance for the first few months. One shock that might hit the young professionals is how much getting drinks for happy hour, transportation, going out to dinner with friends, and online shopping adventures adds up. During our college years, we enjoyed these outings on our parent’s bill. However, this is something that quickly changes post-grad. This realization especially hits when you are forced start to pay bills such as rent, utilities, cell phone, car payment, car insurance, health insurance, and if you have a pet, rent for your pet and vet bills. Not to mention starting to save money for future expenses or those nice vacations that you are used to going on with your parents. According to the Huffington Post, a few tips that may help save a little money (on food) but will add up and help you in the long run are using coupons and reward programs, cooking large meals and eating the leftovers during the week, or even getting friends to pitch in for groceries and make a meals for the group. Look for happy hour specials at local bars and restaurants and bring cash to avoid spending more than your budget. Saving for the future is also a key aspect that you must not forget. Stephen Krochmal, Certified Financial Planner at Ameriprise Financial Services, Inc Walnut Creek, CA said, “I would suggest 10 percent of salary towards 401 k and 10 percent towards savings account to build up for emergency reserves and long-term purchases such as home and cars.” Having emergency funds will help you have a little breathing room and save the stress in the future when and unexpected event occurs. As Krochmal reiterates, it is imperative to begin saving at a young age. He jokes, “Your 50-year-old self will thank you.” As liberated graduates, individuals will have the inclination to go out and spend their paycheck on unnecessary items, so when debating whether you need that shirt or dinner out, think of this financial advice.

Where to Live in Dallas: Finding a personal space that fits both your needs and your budget of the utmost importance when looking for apartments. One of the biggest factors in this equation is, of course, the location. Dallas is a big city with ample living options in different areas, but it all comes down to what you want out of your space. Whether you want to live near work, have easy access to highways to make commuting easier, live near other transportation options, be close to outdoor activities such as the Katy Trail, and still be able to go out without driving, you will find it in Dallas. Another important thing to note is safety, especially if one is living alone. Some apartments are equipped with their alarm systems and security guards on site. The most popular places for post-college students to live in Dallas include Downtown, Uptown, and Knox-Henderson.

Your Apartment: Your first apartment may not be as big as you would have thought or hoped it to be. But we do have tricks to make that 975 sq. ft. apartment seem a tad larger. According to Inhabit, buying furniture that has legs will help create the illusion that there is more floor room and will open up space around the piece of furniture. Having a large mirror that reflects a focal point and light will make the room feel as if it doubled in size. Trying to navigate around the various furniture stores in Dallas is a difficult feat, so to alleviate this task, we’ve put together a guide of the most affordable stores. If you are searching for ‘staple’ furniture pieces such as a family room couch, or a bed frame, look no further than Weir’s Furniture Outlet and Nebraska Furniture Mart. Although these are technical ‘outlets,’ the bargain price surely does not detract from the aesthetics of their furniture. Here, you can purchase a beautiful and functional couch for under $300 (what a steal.) If you are confident in your assembling abilities, Ikea is the place for you. Ikea offers inexpensive, functional, and more modern furniture for all design styles. The only caveat, you must assemble your purchase yourself.

Weir’s Furniture Outlet: 3219 Knox St.Dallas, TX 75205

Nebraska Furniture Mart: 5600 Nebraska Furniture Mart Dr, The Colony, TX 75056

Ikea: 7171 Ikea Dr, Frisco, TX 75034

After you’ve purchased your furniture, it’s time to start decorating. For most individuals, this is the most exciting part about getting an apartment. The best places to start looking for decorative items are, of course, TJMAXX and Homegoods. These two national chains offer premium items at a fraction of the cost. Essentially, it’s a win-win for everyone. Here, you will find the perfect decorative pillow, knick-knacks to hang on your bare walls, and all the other random things you never thought you would need.

We hope this expert help in addition to our personal experiences helps you get the ball rolling post graduation. Although this transition has some negative connotations, it is a time of new beginnings that should truly be embraced. As long as you plan accordingly and strategically, everything will be fine. Get that diploma, your first apartment, and begin the next chapter of your life!

One comment

kcebenefits.com

The SMU Spring 2017 Quick Reference Schedule, updated once a week, is intended to give a person a quick look at all the undergraduate class offerings for a term as well as all graduate Dedman, Meadows, and Lyle classes.

Comments are closed.