Since its first fatality, announced on January 11th, coronavirus has become a hysteria-fueled epidemic. Shelves at supermarkets usually filled with flats of water and non-perishables are bare, face masks for sale on Amazon are on backorder through March, and hand sanitizer has become the new pepper spray.

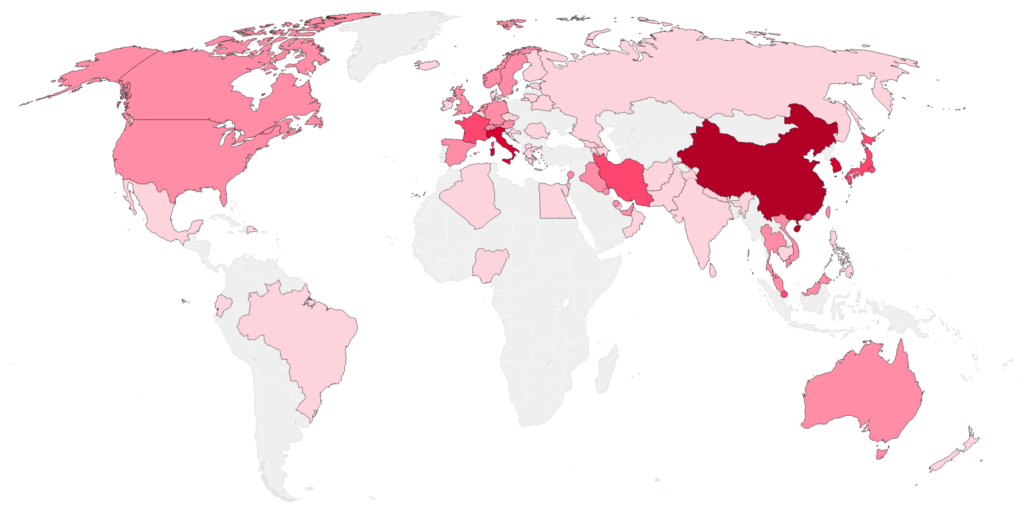

According to Worldometer, there have been a total of 88,342 cases and 3,001 deaths related to coronavirus. Currently, 42,613 are infected with COVID-19, with China, Iran, and Italy leading in both the number of cases and deaths. China has reported over 577 new cases, while Italy and Iran have reported 566 and 385 new cases, respectively. Now, as cases multiply and hysteria reaches new heights, coronavirus is infecting consumers and the economy alike—and the luxury market is feeling the pain.

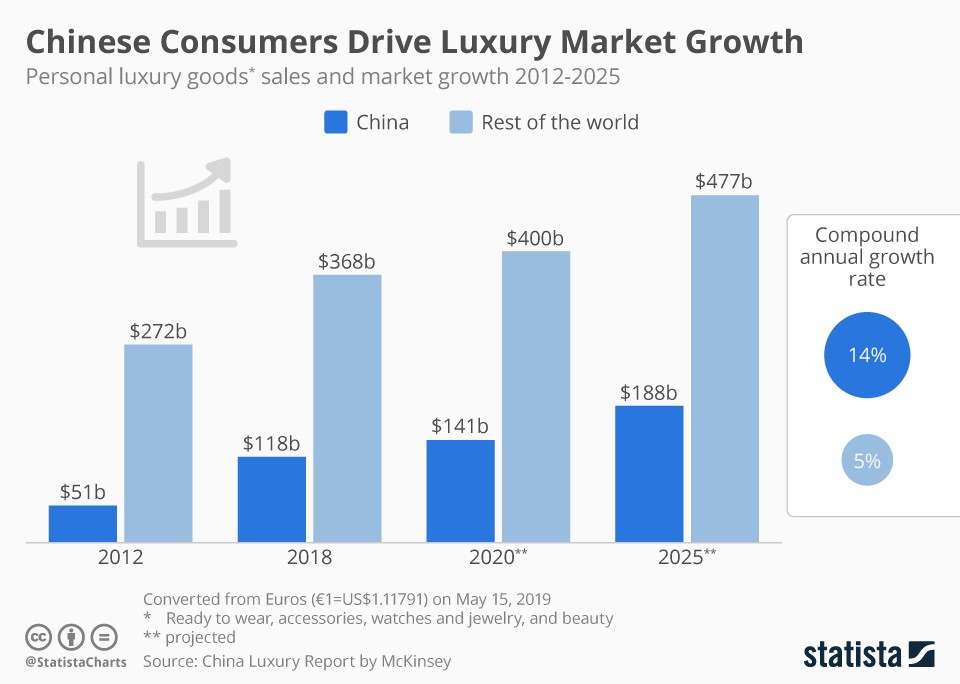

When coronavirus first broke out, luxury brands feared for the effect on Chinese consumers, specifically. According to Vogue Business, Chinese shoppers today are responsible for a third of the nearly $287 billion spent on personal luxury goods. However, by 2025, Chinese consumers are projected to make up 46% of luxury goods purchases by and to help the expected spending on luxury goods to jump to an awe-inspiring $331 billion, increasing their stake in luxury brands’ profits from 9% to a whopping 22%.

However, as China becomes a nation on lockdown, these projections are unlikely to hold, with Business of Fashion predicting $43 billion in losses for luxury brands as a result of coronavirus. Not only are stores within mainland China closed indefinitely—including most of Tapestry’s 319 storefronts and 150 of Capri Holdings’ 225 stores—but Chinese tourism has ground to a halt—a death knell for high fashion, as Chinese tourists splash out more than $75 billion overseas annually.

Now, as the virus spreads beyond the confines of China to South Korea, Italy, and most recently, the US, it’s no longer just Chinese consumers that high fashion has to worry about, but global consumerism. In the last week, the stock market suffered its worst week since the 2008 financial crisis, with the S&P 500 dropping 11.5% and shaving off nearly $3.2 trillion in value. Crude oil, traditionally a good barometer for market pressures, showed the strain, plunging 4.9% on Friday to settle at $44.76/barrel, closing below $46 for the first time since December 2018. Finally, gold futures, usually considered a safe-haven in a volatile market, were down 4.6% at the close on Friday, sinking to $1,564.10/oz.

Luxury stocks had an equally grisly week, with most fashion conglomerates posting $2-$3/share losses over a 5-day period. LVMH (LVMUY) ended the week at $82/share after starting at $84/share, Kering (PPRUY) ended at $56.40/share after starting at $58.20/share, and Capri Holdings (CPRI)—owner of Michael Kors, Jimmy Choo, and Versace—ended the week at $25.81/share after starting at around $27/share.

Ultimately, coronavirus has created a level of uncertainty in the luxury market that extends beyond just Chinese consumers. As markets post losses reminiscent of the Great Recession and COVID-19 continues to run rampant, there seems to be no limit to the havoc coronavirus can wreak or how far into the red we can go.