For over a month, the fear of coronavirus, or COVID-19, has gripped Americans, causing school closures, mandatory shutdowns, and other unreasonably drastic measures to curb a virus that has killed fewer people than this seasons flu. And, as the government ramps up restrictions, locking down entire states and forcing businesses to close indefinitely, the economy has ground to an unprecedented and frightening halt. However, Americans seem to be ignoring these warning signs, instead urging people to stay inside to avoid a virus that will inevitably spread to everyone at some point. Ultimately, the question becomes: how far are we willing to let the hysteria go before the economy is too damaged to salvage?

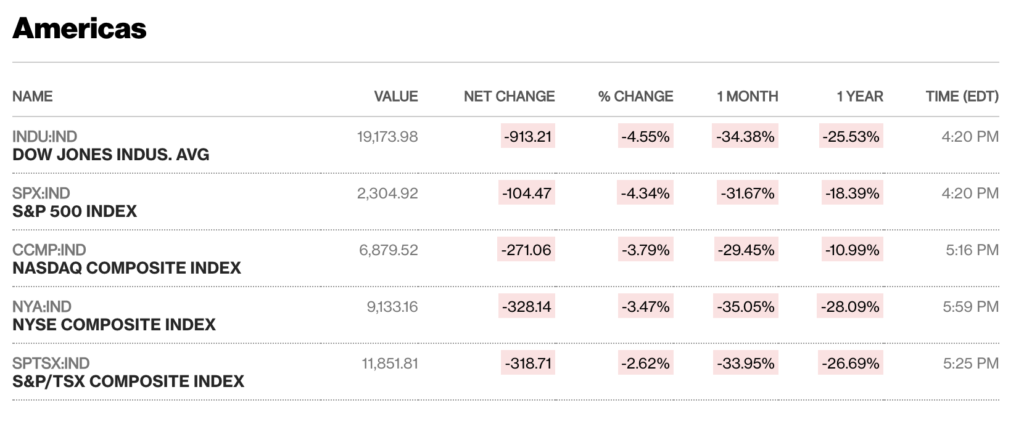

The market has already taken a substantial hit from coronavirus. Well before cases of COVID-19 were reported in the Northwest US, the markets showed investors’ unease, specifically in regard to how the virus would affect the Chinese economy, and in turn, the US economy. However, as an extraordinarily ego-centric nation, the full weight of the virus didn’t hit Americans until it was upon us, driving stocks down to lows not seen in 30 years.

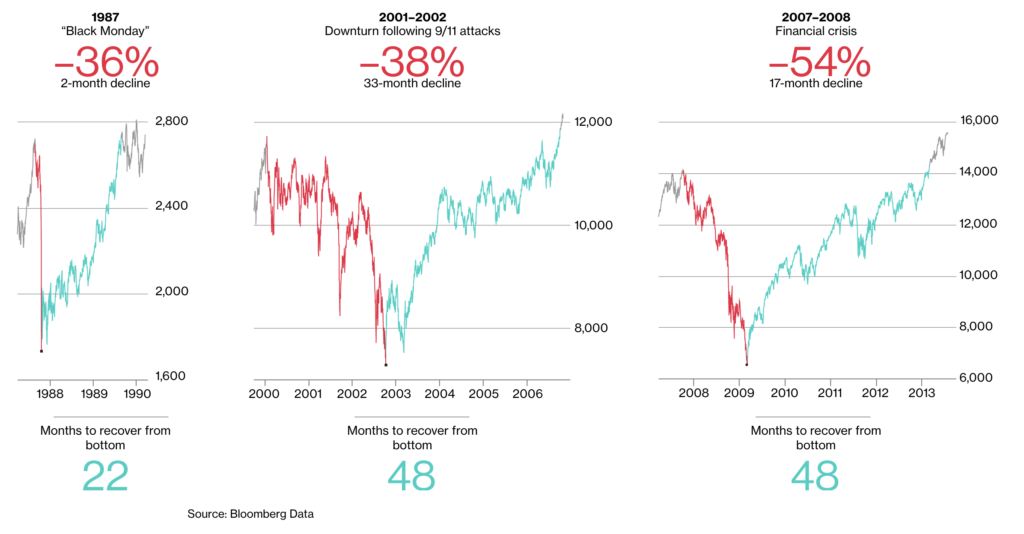

On March 12th, the stock market suffered its worst crash since October 19th, 1987, better known as “Black Monday,” with both the S&P 500 and Nasdaq dropping a collective 16% and placing them firmly in bear territory, according to Bloomberg. Even more alarming, trading in the S&P 500 triggered a record three “circuit-breakers,” mandatory trading halts designed to keep the market from bottoming out. To put this into perspective, a circuit-breaker hasn’t been triggered since 9/11.

Since then, the market has been frighteningly volatile, dropping hundreds of points at a time, sinking 5-7% one day before climbing 2-3% the next day. According to Bloomberg, the S&P 500 dropped 15% over the last week, bringing the market to a 3-year low and making it the market’s “worst week since 2008.” Furthermore, despite proposed government stimulus packages to the tune of $1.5 trillion, the market has been sluggish to react to imminent relief.

Ultimately, this trading rollercoaster only breeds more insecurity and heightens the potential for another massive drop—a potential burden America’s severely wounded economy can’t shoulder right now.

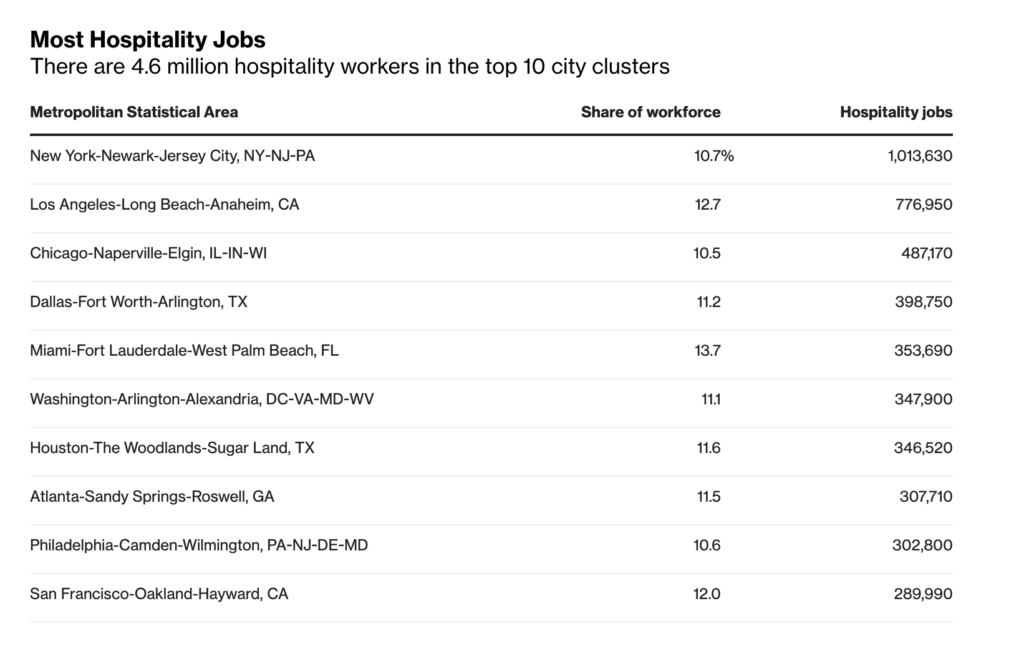

With government restrictions tightening and the CDC encouraging increased “social distancing,” the economy has come to a standstill as “non-essential” employees are forced to stay home, and the hospitality industry, comprised of restaurants, hotels, clubs, and the like, has been put on lockdown. This only pushes the economy further to the brink, as both hourly and salaried workers alike file into unemployment offices, desperate for help as they become indefinitely unemployed.

To put this in perspective, when massive sectors of the service industry are closed (shopping, restaurants, gyms, hotels, etc.) the economy slows to a halt—literally. Thus, people can’t go out and spend money, so people in those industries don’t make any money. Ultimately, this cycle creates a ripple effect throughout the rest of the economy, attacking the core first before disrupting the top.

California has put this to the test, mandating an indefinite statewide “lockdown,” locking down the second-largest economy in the US—40 million people—with the market in its worst rout in nearly thirty years and GDP projections already being cut by a shocking 15-20% before these drastic measures.

It is truly appalling that we have not acted more rationally in response to this “pandemic.” Yes, we should take necessary precautions in order to keep ourselves and others safe, but with the economy tanking the way it is, it’s time to reacquaint ourselves with reality. The truth of the matter is that, of over 14,000 reported cases in the US, there have only been 500 deaths. And, as many experts, both in the financial and health care fields alike have noted, there are likely far more cases than this, because most people are asymptomatic. However, the fact that there are far more cases than are being reported doesn’t mean the virus is “deadlier” or that it is “spreading at a faster rate,” as is the common misconception. In reality, it means that most people have had it and they’ll never known it.

In closing, it’s time to decide how much we are willing to let the virus hysteria control us. While being cautious is good, halting normal life to prevent the spread of a virus that has already spread and will continue to spread without most people knowing will have catastrophic consequences for the economy that will be around well after all of this panic goes away.

Ultimately, it’s time to regain our common sense and stop allowing our emotions to control our decision making. We must be more practical and discerning, not swayed by our bleeding hearts. We must fix the economic damage we’ve done in our frenzied short-sightedness before the markets close and the economy is too damaged to salvage.

In this moment, we can no longer afford for our emotions to decide our actions; rather, we must look at this situation in terms of cost-benefit analysis. We must stop the madness before it swallows us whole.