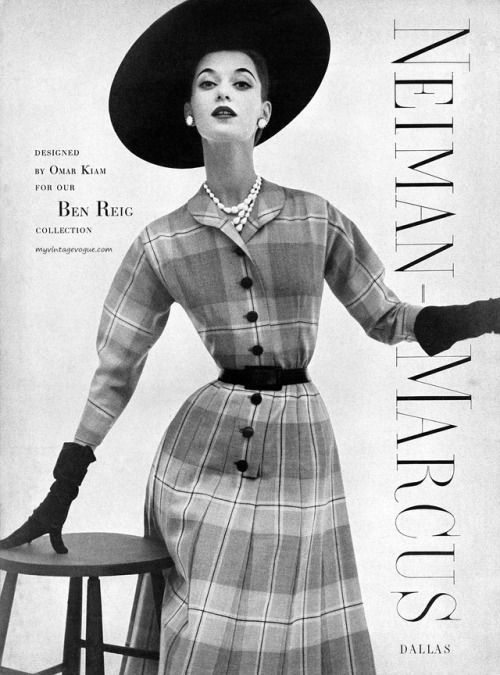

Founded in 1907 in Dallas, Texas. by Herbert Marcus Sr. and his sister Carrie Marcus Neiman, Neiman Marcus has become a retail icon. With 43 stores, 24 Last Call stores, the brand’s discount locations, and 2 Bergdorf Goodman stores in NYC, the Neiman Marcus Group has grown from its first location on Preston Road to an international retail giant. However, with the coronavirus outbreak, the group is set to declare bankruptcy “as early as this week,” according to people familiar with the matter.

In recent years, Neiman Marcus has suffered as consumers shift to online retail platforms, where they can often find the same pieces as they would in department stores, but for slightly less. Sites like Farfetch and MyTheresa, and groups like Yoox-Net-a-Porter (YNAP), owned by French super conglomerate Richemont, have invaded the retail space and put increasing pressure on department stores, like Neiman Marcus, whose margins are already razor-thin thanks to huge storefronts and massive inventories.

Unfortunately, the coronavirus outbreak has pushed Neiman Marcus over the edge. Not only has the company been forced to close its doors for over a month, furloughing most of its 14,000 employees, but it has been forced to compete directly with online retailers whose marketing, PR, and social media presence crush the storefront-dependent department store in the battle for quarantined consumers’ attention. Additionally, the stock market’s volatile behavior and glaring recession indicators loom, omens that do not bode well for increasing nor maintaining its sales.

Not only is Neiman Marcus’s sales outlook unforgiving, but it has saddled itself with nearly $5 billion in debt over the past few years, according to Standard & Poor’s. On top of that, the group skipped a bond payment amidst negotiating with its creditors for hundreds of millions in relief money to keep its operations afloat during its bankruptcy negotiations.

Sadly, it seems that the iconic Dallas store has no choice but to close its doors. Hopefully, it can use bankruptcy as a fresh start, a way to restructure its mismanaged assets. However, with mounting debt, idle inventory, a waning customer base, and an unfriendly economic climate, it seems that much-loved Neiman Marcus will likely follow in Barneys’ footsteps as another fallen retail giant.