Thanks to COVID-19, the luxury market has been forced to face its greatest fear: eternal storefront closures, a complete lack of consumer confidence, and broken supply chains. As a result, coronavirus’s far-reaching effects have claimed some of the biggest names in fashion. Unfortunately, the worst may be yet to come.

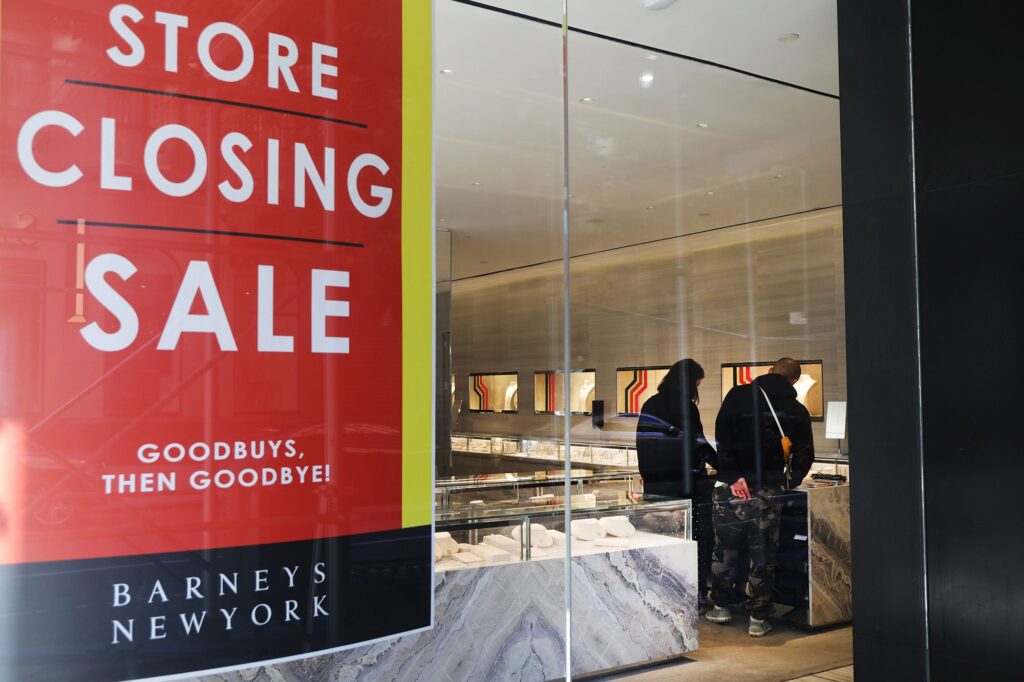

Prior to March of 2020, the fashion industry had already had a tough go of it, losing iconic department store chain Barneys New York in August of 2019, French luxury label Sonia Rykiel in July of 2019, and American teen favorite Forever 21 in September. After such a dismal 2019, analysts had high hopes for 2020. However, just as the fashion industry regained its footing, COVID-19 hit. The pandemic lead to shuttering boutiques and forced an industry that thrives on its tactility and in-store experiences to operate completely online. As these mandatory closures drag on and consumer confidence wains thanks to the hyper volatility of the market, independent labels have drowned in debt. As a result, COVID-19 has forced some of the most recognizable fashion conglomerates and brands to file for Chapter 11 bankruptcy.

Of the myriad brands that have filed, a few stand out. One of the biggest names to fall was Neiman Marcus, the historic department store chain started in 1907 in Dallas, Texas. With Neiman’s went Bergdorf Goodman, its sister store. J.C. Penney and Lord & Taylor, both classic American department stores, also filed for Chapter 11 in May of 2020 and August of 2020, respectively. In addition to department stores, who were arguably the hardest hit by seemingly-eternal closures, independent labels including Brooks Brothers, J. Crew, Lulu Guiness, ALDO, John Varvatos, True Religion, G-Star Raw, and even Diane von Furstenburg’s London-based studio all filed for Chapter 11 bankruptcies. While it is sad to see many of these brands go under, for most of them, COVID-19 simply brought their underlying problems to light, pushing their unsustainable debt over the edge. However, as COVID-19 continues to wreak havoc on consumer confidence and reopening plans are pulled back, once-safe luxury brands are beginning to feel the heat. Unfortunately, if they continue underperforming and operating at unendurable losses, they may be next in line for bankruptcy court’s chopping block.

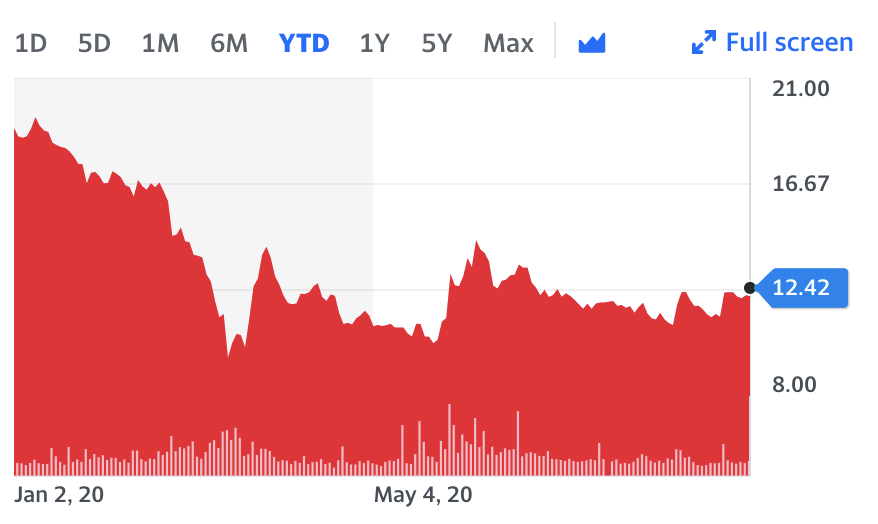

Small, family-owned brands like Salvatore Ferragamo and Tod’s have already begun showing worrying signs of decline. According to Reuters, in the first quarter (Q1), Ferragamo’s (SFER.MI: MILAN) sales fell a whopping 30%. In the second quarter (Q2), the brand’s sales fell an eye-watering 60%, with only $442 million in sales. Tod’s (TOD.MI: MILAN) experienced equally abismal results. Not only did its sales fall 30% in Q1, but it released a press release stating it would not be distributing a dividend to its shareholders this year.

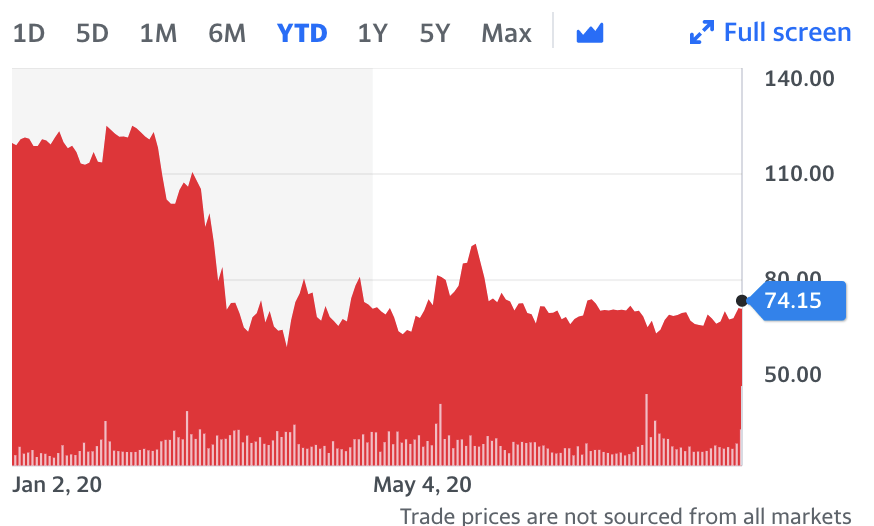

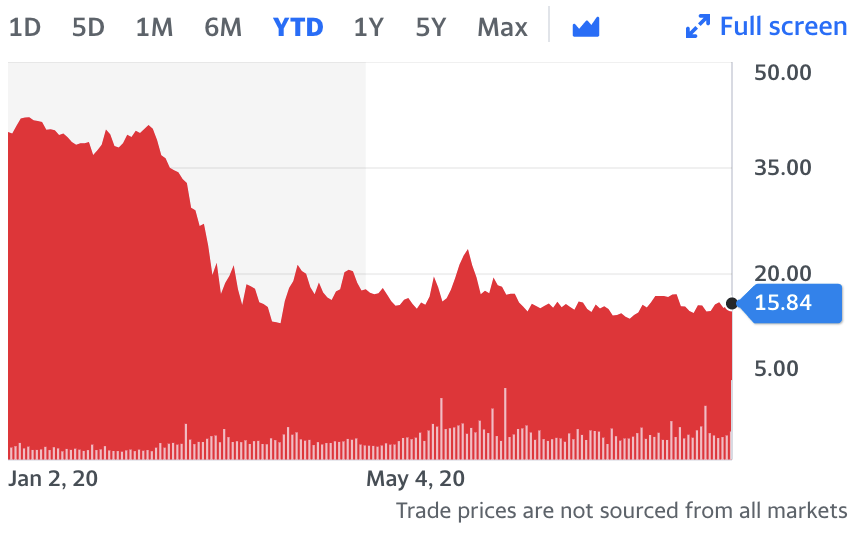

Fashion conglomerate Tapestry (TPR: NYSE), which owns Coach, Kate Spade New York, and Stuart Weitzman, has continued its slump, as has ailing department store giant Nordstrom (JWN: NYSE). Before the Dow’s terrifying nearly 3,000 (12.53%) drop on March 16th, Tapestry was trading at $24.35/share, and Nordstrom at $40.54/share. Now, though the companies have started to pick themselves up, the fashion industry has been slow to find its footing in the current economic climate. As a result, reclaiming their former stock prices seems impossible. Currently, Tapestry trades at $14.71, while Nordstrom finished the day at $15.84.

Ultimately, I believe that the list of beloved brands going under will continue to grow as we move through 2020 and into 2021. With uncertainty still gripping consumers and the stock market remaining obnoxiously volatile, even well-insulated conglomerates like LVMH, Kering, and Richemont aren’t safe from the Chapter 11 curse.