On November 25th, 2019, LVMH announced it would be acquiring iconic American jeweler Tiffany & Co. for an eye watering $16.2 billion in what would have been the biggest merger in luxury history. However, on September 9th, reports surfaced via Business of Fashion that LVMH “wouldn’t be in a position to realize its plan to acquire Tiffany & Co.” As a result, Tiffany is suing LVMH for breaching its merger agreement, and things are getting messy.

In what has been one of the toughest years on record for the luxury market thanks to the effects of COVID-19, it’s no surprise that companies who had agreed to deals prior to the pandemic aren’t eager to pay up. However, merger agreements don’t allow for contingencies, pandemic or otherwise.

In order to understand the contentions between the two parties, let’s break down the merger agreement. Tiffany and LVMH entered into the agreement on November 24th, 2019. The agreement had to be approved by the majority shareholders of both parties, and LVMH assumed all antitrust risk related to clearing the merger through international antitrust agencies who have a vested interest in the deal, including the Canadian Competition Bureau, The Federal Antimonopoly Service of Russia, and Market Regulation of China, among others.

The Merger also needed to satisfy the following “closing conditions:” (a) regulatory approvals—this includes clearing antitrust agencies—(b) the absence of law or order that enjoins, prevents, or prohibits the consummation of the pending Merger—lawsuits—and (c) the absence of a Material Adverse Effect (MAE)—a significant change in circumstances of the company being acquired such that it reduces the value of that company prior to a merger. For the most part, MAEs only occur when a company hides massive problems from its acquirer or lies about its PPE (plant, product, and equipment).

Both parties agreed on an initial “outside date,” better known as a closing date, of August 24th, 2020, by which LVMH would have had plenty of time to get the required regulatory clearances in order. However, should regulatory processes take longer than expected, either party could extend the closing date to November 24th, 2020, so long as antitrust clearances were the only remaining hurdle to closing as of August 24th.

Not only has LVMH failed to meet the closing conditions outlined above, but as of August 24th, 2020, the conglomerate has yet to even file for antitrust approval in three of the required jurisdictions. Even worse, the group has falsely claimed it cannot complete the deal due to US-French trade tensions. Now, with the extended closing date less than three months away and still no action from Chairman Bernard Arnault, Tiffany & Co. has had “no choice” but to file suit according to CEO Alessandro Bogliolo.

LVMH alleged that it discovered a letter from the French European and Foreign Affairs Minister dated August 31st, 2020, which, in reaction to the threat of taxes on French products by the US, directed the conglomerate to defer the acquisition of Tiffany & Co. until after January 6th, 2021.

Unfortunately for LVMH, there is no basis under French law for the Foreign Affairs Minister to order a company to breach a binding Merger Agreement. Furthermore, LVMH’s discussions with the French government without notifying Tiffany and its general counsel are yet another breach of contract.

In his September 9th statement, Tiffany’s Chairman, Roger Farah, slammed LVMH’s letter farce and the group’s “concerted efforts to delay or avoid receipt of regulatory approval,” saying that LVMH would use “any available means in an attempt to avoid closing the transaction on the agreed terms.”

In its September 10th press release, LVMH fired back, deeming Tiffany’s claims “defamatory,” and saying it was “surprised” by the “unfounded” lawsuit. The statement went on to say that the necessary antitrust clearances would be filed in the coming days “as expected,” before tearing into Tiffany’s performance, calling its first half results and 2020 outlook “very disappointing” and “significantly inferior to those of comparable brands of the LVMH Group during this period.”

This aggressive accusation, however, is completely baseless. Though Q1 and Q2 of 2020 were tough on luxury, Tiffany performed solidly compared to its competitors. Despite a loss of $83.1 million in Q1, the company returned to profitability in Q2, with earnings of $91.4 million, resulting in $8.3 million in earnings for the first half of 2020. While LVMH still managed a profit of $18.4 billion for the first half of 2020, the conglomerate is down 27% from its 2019 first half earnings of $25.1 billion. And, given that LVMH’s market cap is more than 16 times that of Tiffany’s, both groups performed admirably given the disastrous economic climate.

Now, with its letter from the Ministry of Foreign Affairs being called out as legally groundless and completely unethical, LVMH is countersuing Tiffany for “crisis mismanagement” in another feeble attempt to weasel out of the monster deal. In its September 10th press release, LVMH claimed that Tiffany’s handling of the COVID-19 crisis was “impacted by an MAE,” alleging that the company’s Board of Directors “did not follow an ordinary course of business,” as it distributed “substantial dividends” to shareholders while the company was “loss making.” Unfortunately for LVMH, continuing to distribute a dividend to shareholders despite losses does not constitute an MAE.

Ultimately, no matter the excuse LVMH throws out or the flimsy argument it concocts, the fact remains: merger agreements do not account for pandemics. At signing, LVMH assumed all financial risk related to adverse industry trends or economic conditions. And, with a market capitalization of $200 billion and a record of profitability despite the massive economic downturn, the State of Delaware will have no problem forcing the deep-pocketed French syndicate to follow through on its $16.2 billion deal.

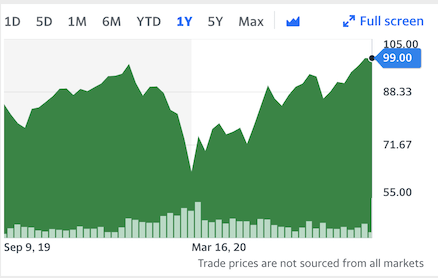

Come October, the Delaware Court will likely enforce the merger. However, regardless of the decision, LVMH will face serious, obliterating fallout. Renowned for its aggressive acquisitions, the group’s extremely convenient and painfully public tit-for-tat countersuits against Tiffany will impair its ability to make deals with companies in the future. Furthermore, LVMH’s conduct will hurt its stock performance. As both a loyal LVMH and Tiffany investor, I’m embarrassed by Bernard Arnault’s blatantly illegal, unfounded attempts to back out on such a pivotal deal.

Ultimately, If LVMH’s scheming works, it will have successfully passed up on completing what could have been the most lucrative deal in its history and adding what could have been one of its most valuable companies to its massive portfolio.

Oh well–As the French would say, c’est la vie.